Local cement producers are making

submissions to the International Trade Administration Commission of South

Africa (Itac) to impose tariffs on cement imports from China and Vietnam in a

bid to protect the South African industry.

Cement imports grew 166.4% and

144.1% year on year in September and October 2018, respectively, according to

Industry Insight, which provides market information on the construction

industry.

The first 10 months of last year

saw 849,781 tonnes of concrete being imported, representing an increase of

104.7%, compared with the same period in 2017. Data from the South African

Revenue Service shows that higher than average imports of more than one million

tonnes are expected this year.

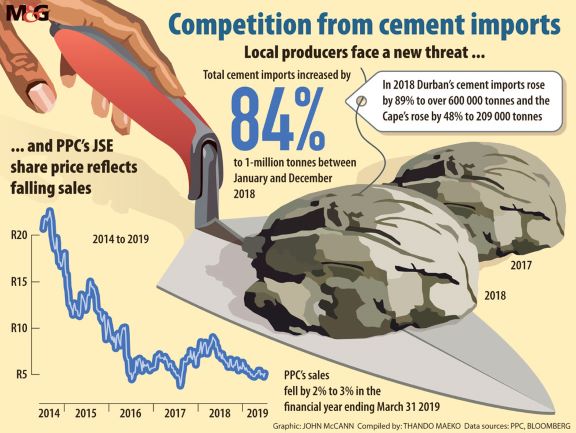

PPC, the JSE-listed supplier of

cement and lime, earlier this year reported that, “Cement imports increased by

84% to 1-million tonnes for calendar year 2018, albeit off a relatively low

base.

Imports

received via Durban increased by 89% to more than 600 000 tonnes, while imports

received in the Cape rose by 48% to 209 000 tonnes,” adding pressure to an

already struggling construction industry.

For the year ending March 31

2019, PPC reported that sales declined 2% to 3%. This decline was partly a

result of increased competition from imports, which rose by 84% in 2018.

The Concrete Institute (TCI),

which represents the major cement producers in the country – PPC, AfriSam,

Lafarge, Sephaku Cement and Natal Portland Cement – says the oversupply of

cement has left it with no choice but to approach Itac to “safeguard” local

producers from cheaper imports.

“The increase in imports of

cement is affecting demand for locally produced cement to such an extent that

[South African] manufacturers are considering mothballing plants, retrenching

staff and putting expansion plans on hold,” the institute said in a statement

in March.

In 2015 Itac, which sets and

investigates tariffs on imported goods, imposed anti-dumping duties on imports

from Pakistan after an investigation that found that cement imports from the

South Asian country were causing material injury to the local cement industry.

Itac had imposed duties as high

as 77% on Pakistani cement, which has eased some pressure on South African

cement producers. The institute says although the intervention by Itac levelled

the playing field between local cement producers and Pakistani producers, China

and Vietnam have stepped into the gap.

“The cement, concrete and

affiliated industries employ thousands of South Africans whose jobs would be on

the line if the government does not step in to protect local cement

production,” says Bryan Perrie, MD at TCI.

The institute’s figures show that

the sector already faces a supply and demand mismatch. Local producers can

manufacture about 19- to 20-million tonnes of cement annually, while demand

stands at 13-million tonnes a year.

Apart from supply and demand

dynamics, local manufacturers are also subject to rigorous regulations,

including environmental impact assessments, strict quality controls, and labour

and employment regulations.

“Such processes are not always

required with products manufactured outside of South Africa. While we do not

view these regulations as problems, and we are supportive of their objectives,

they do add to the cost of doing business and, in turn, to the price the end

user pays,” Perrie says.

Other factors that have had

significant effect on the overall cost of producing cement include slow

economic growth, which has put added pressure on the country’s construction,

cement and concrete industries.

The rolling electricity cuts in

the first quarter of the 2019 have also increased the cost of production.

Azar Jammine, the chief economist

at Econometrix, says that imposing tariffs in the short term could provide some

relief for local cement producers but that for the industry to be protected,

huge investment in the country’s infrastructure is needed.

“The cement industry is [having]

a hard time because of low levels of demand because of very weak levels of

activity in construction,” he says “But from a long-term point of view the

solution to the problem is to increase investment.”

Data from Statistics South Africa

also showed that construction sector remains in the doldrums, decreasing 2.2%.

This is far from the highs before the Fifa World Cup in 2010, when there was

major spending on infrastructure.

Nine years on and one of the country’s biggest

construction firms, Group Five, had its stock suspended in March after the

company filed for bankruptcy protection.

Basil Read is another one of the

five construction industry giants that has barely kept its head above water. It

began a business rescue process in June last year. And in June this year, the

company retrenched all staff not working on specific projects. The company also

moved its headquarters to smaller offices in Johannesburg.

As part of his plan to fix the

country’s sluggish economic growth, in February President Cyril Ramaphosa

announced the government’s plans to inject R100-billion into the Infrastructure

Fund over the next decade. Ramaphosa said the plan includes a “special package

of financial and institutional measures to boost construction”.

Jammine has questioned the

government’s plan, saying, “I’m waiting to see the R100-billion. We’ve been

hearing about it for a long time and there are very few signs of it actually

manifesting … as yet.”

Perrie says the investment in the

construction sector is a step in the right direction, adding that, “The key to

future growth lies in achieving greater efficiencies within the country’s

relevant manufacturing sectors. The cement industry needs to compete on a level

playing field and not be scrambling to survive against under-priced imports.”

Stanlib analyst Kobus Nell says local producers should ensure that consumers understand that South African cement is of a higher quality than the cheaper imports to encourage increased demand for local products.https://mg.co.za/article/2019-07-11-00-under-pressure-cement-sector-wants-tariffs