Caption: Suzette van der Walt, consulting manager infrastructure advisory at Zutari.

By Lloyd Wallace, Technical Director and Expertise Lead, Infrastructure Advisory, Zutari; and Suzette van der Walt, Consulting Manager, Infrastructure Advisory, Zutari. This is Part 1 of a two-part article.

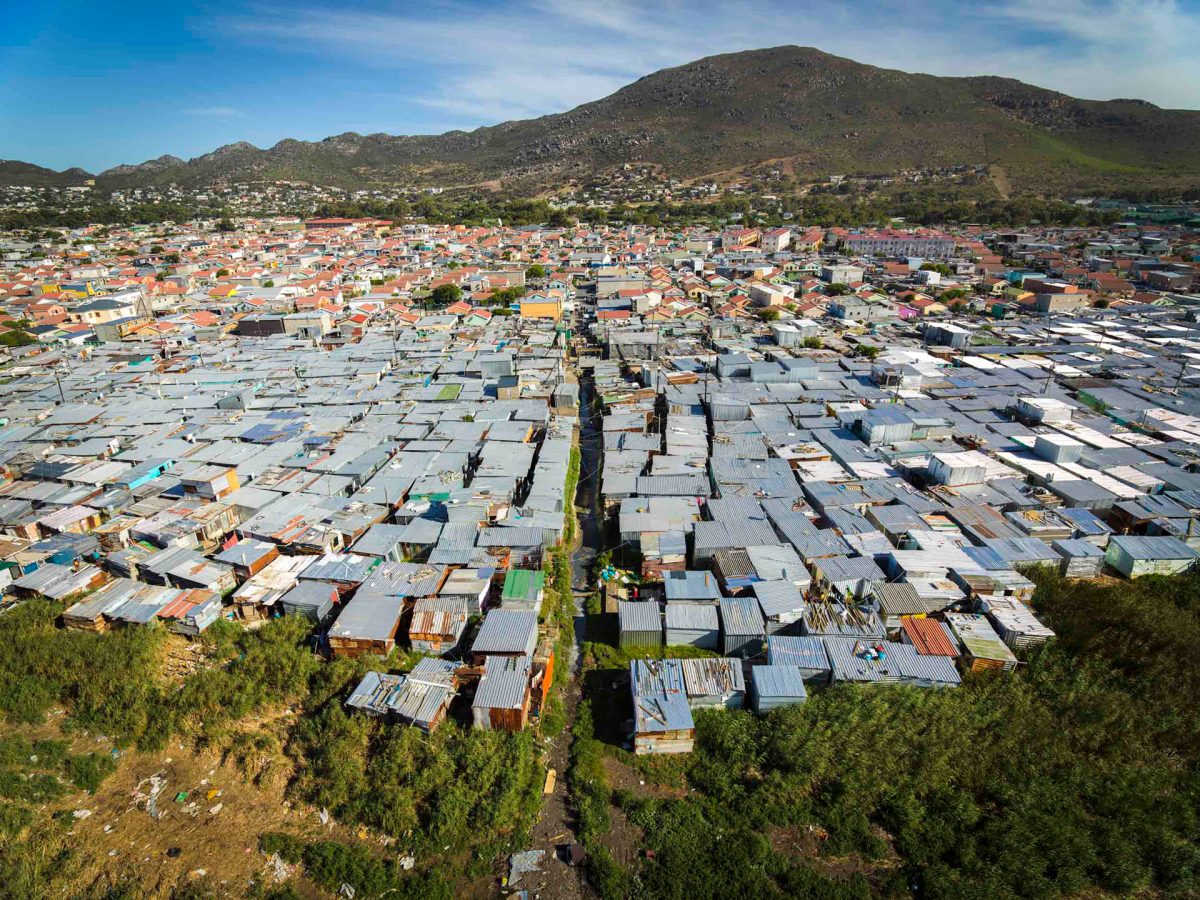

Affordable housing remains a complex challenge, with varying interpretations of what ‘affordable’ actually means. According to the World Bank, housing is considered affordable when it costs below 30% of the average household income. In South Africa, the term often invokes thoughts of government-subsidised housing, notably the Reconstruction and Development Programme houses and its successor, called Breaking New Ground.

Affordable housing initiatives span a spectrum of models, from Informal Settlement Upgrading (UISP) and site-and-service provision to ownership models like RDP and first home finance (formerly FLISP). Social housing, a privately owned and subsidised rental housing option, along with public housing and community rental units (CRUs), further diversify the landscape of subsidised housing.

Amid this complexity, the private sector plays a pivotal role in developing affordable housing and introducing innovative models like sub-market rental and subsidised social housing. Affordable housing, considered a crucial element of economic redress, is a public good when it provides safe, good-quality housing. It provides the foundation for upward mobility and contributes to positive urban environments.

Private sector involvement brings its typical advantages, but some challenges need careful consideration. The grant-based nature of subsidies, particularly those directed to Social Housing Institutions (SHIs) for project capital finance, may inadvertently disincentivise comprehensive asset renewal budgeting. Without a viable exit strategy or a larger share of liability for developers, there is a risk of social housing projects falling into a state of disrepair once the capital commitments (sometimes as low as 30% of total development cost) have been met.

Addressing these challenges requires innovative solutions, especially as South Africa – which is not considered a poor country – therefore has limited access to impact finance focused on social initiatives. However, there is far more green impact finance available from investors with an appetite to be become involved in South Africa.

The refurbishment of existing housing stock aligns with green principles, as it is inherently more sustainable than the construction of new structures. Infill design, a strategy that enhances urban density and reduces pressure on infrastructure networks, can further contribute to environmental and social sustainability.

Continued in Part 2…

More news

- CELEBRATING EXCELLENCE IN THE RESIDENTIAL PROPERTY SECTOR

- PART 4: GIBS PANEL DISCUSSES INTEMEDIATE CITIES ROLE IN AFRICA’S DEVELOPMENT

- EXPOSED AGGREGATE PAVERS COMPLEMENT NEW LIFESTYLE CENTRE

- GIBS PANEL EXPLORES ROLE OF INTERMEDIATE CITIES IN SA’S DEVELOPMENT PART 3

- CITI-CON’S CONCRETE KNOWLEDGE SUCCESSFULLY DEPLOYED ON NEW LANDMARK DEVELOPMENT