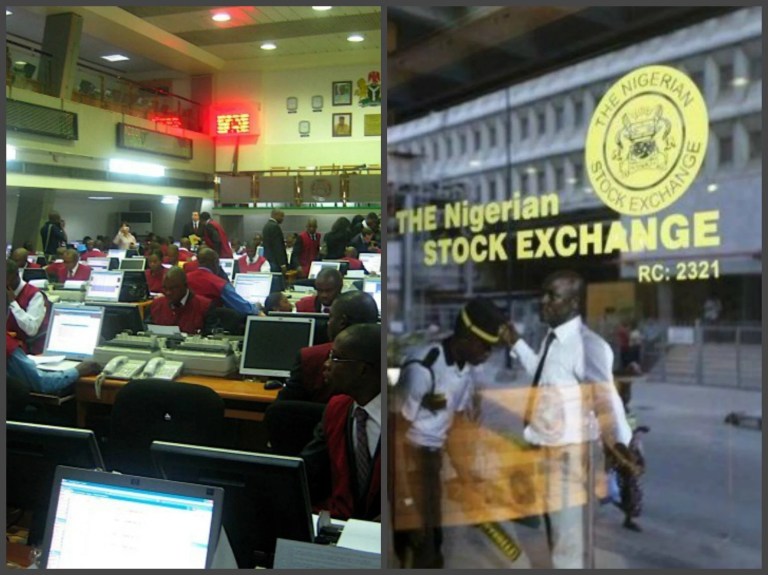

Cement company Lafarge Africa swung to a loss in the second quarter and announced plans for a share issue to reduce debt, sending its share price to an eight-year low on Tuesday.

After reporting a post-tax loss of 1.9 billion naira ($6.22 million), against a 14.6 billion naira profit in the same period last year, CFO Bruno Bayet told Reuters the company would issue 90 billion naira in shares to existing shareholders by the end of the year.

Shares in the company, a unit of Franco-Swiss group LafargeHolcim, fell 10% to 29.25 naira, their lowest level since March 2010. “Nigeria continues to have strong growth. If we compare with Q2 last year the market grew by 22%. The reason for the loss is mainly from South Africa,” Bayet said.

Lafarge Africa announced a loss of 40.37 billion naira in 2016, weighed down by foreign currency debt after Nigeria slipped into its first recession in a quarter of a century. It returned to profit last year, but higher finance charges and losses from South African operations have hurt the business this year, triggering another cash call aimed at reducing debt to boost profitability.

Lafarge Africa raised $132 million at the end of 2017, its first equity sale in a decade, backed by its parent. Bayet said the latest share sale would be to repay about $20 million of a $350 million loan advanced by LafargeHolcim and to repay a 33 billion naira of commercial paper.

He said he expects South African operations to improve in the second half of the year.

More news

- CELEBRATING EXCELLENCE IN THE RESIDENTIAL PROPERTY SECTOR

- PART 4: GIBS PANEL DISCUSSES INTEMEDIATE CITIES ROLE IN AFRICA’S DEVELOPMENT

- EXPOSED AGGREGATE PAVERS COMPLEMENT NEW LIFESTYLE CENTRE

- GIBS PANEL EXPLORES ROLE OF INTERMEDIATE CITIES IN SA’S DEVELOPMENT PART 3

- CITI-CON’S CONCRETE KNOWLEDGE SUCCESSFULLY DEPLOYED ON NEW LANDMARK DEVELOPMENT